Colo. postal worker sentenced for swiping packages - FoxNews.com: "A former Denver-area postal worker who pleaded guilty to stealing more than 11,000 packages and then selling their contents has been sentenced to 2.5 years in federal prison."

"The Postal Service estimates the losses at $283,913, but say there's no way to know how much was stolen."

That seems like a light sentence.

Tuesday, November 30, 2010

What Republicans Can -- And Can't -- Do about ObamaCare | Michael D. Tanner | Cato Institute: Commentary

What Republicans Can -- And Can't -- Do about ObamaCare | Michael D. Tanner | Cato Institute: Commentary: "Democratic Senator Ron Wyden of Oregon had asked for his state to be exempted from many of the law's provisions, including the individual mandate. Republicans should push to give it to him, and encourage other states to apply as well.

Republicans should also start laying out their own positive alternatives. It's not enough to simply repeal ObamaCare. Republicans will have to show that they have their own proposals for dealing with health care costs and the uninsured. They had a number of good ideas during the debate over reform, ranging from allowing the purchase of insurance across state lines to changing the tax treatment of individually owned insurance, but those ideas couldn't get much of a hearing while the president controlled the agenda. Now they can.

Finally, Republicans in the House now control the power of the purse. They should refuse to fund implementation of the bill. For example, the IRS says it will need to hire as many as 13,500 additional IRS agents to administer the law's unpopular individual mandate. Congress should refuse to appropriate the money to do so."

Republicans should also start laying out their own positive alternatives. It's not enough to simply repeal ObamaCare. Republicans will have to show that they have their own proposals for dealing with health care costs and the uninsured. They had a number of good ideas during the debate over reform, ranging from allowing the purchase of insurance across state lines to changing the tax treatment of individually owned insurance, but those ideas couldn't get much of a hearing while the president controlled the agenda. Now they can.

Finally, Republicans in the House now control the power of the purse. They should refuse to fund implementation of the bill. For example, the IRS says it will need to hire as many as 13,500 additional IRS agents to administer the law's unpopular individual mandate. Congress should refuse to appropriate the money to do so."

Monday, November 29, 2010

NJ school district: No D-grades policy a success - FoxNews.com

NJ school district: No D-grades policy a success - FoxNews.com: "Reynolds had proposed the policy last summer, saying he was tired of kids getting credit for not learning."

Tax break for employer health plans a target again - FoxNews.com

Tax break for employer health plans a target again - FoxNews.com: "The idea isn't to just raise revenue, economists say, but finally to turn Americans into frugal health care consumers by having them face the full costs of their medical decisions."

Taking the employer out of the health care picture has many benefits: More plan choices, better plan fit, cost savings.

Taking the employer out of the health care picture has many benefits: More plan choices, better plan fit, cost savings.

State workers will pay into pension fund | Hudson Star-Observer | Hudson, Wisconsin

State workers will pay into pension fund | Hudson Star-Observer | Hudson, Wisconsin: "Right now the state pays the entire employee contribution to the pensions of most state and university workers. That will change in January 2011, if only in a small way.

Most state workers will have to pay 2/10 of one percent of their retirement contributions. For an employee making about $40,000, that amounts to about $80 each year."

Did you see that? The state pays the "employee" portion!

Most state workers will have to pay 2/10 of one percent of their retirement contributions. For an employee making about $40,000, that amounts to about $80 each year."

Did you see that? The state pays the "employee" portion!

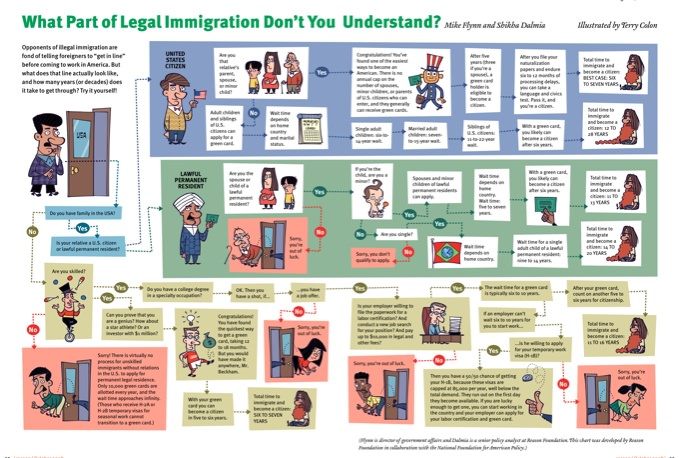

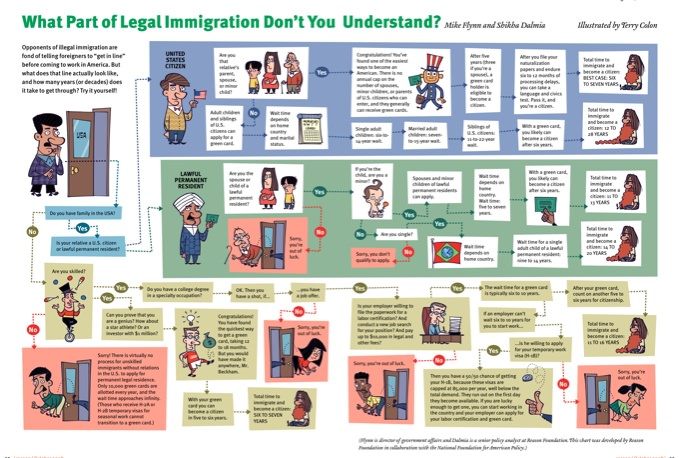

New at Reason: Mike Flynn, Shikha Dalmia, and Terry Colon on America's Absurd Immigration Waiting Line - Hit & Run : Reason Magazine

New at Reason: Mike Flynn, Shikha Dalmia, and Terry Colon on America's Absurd Immigration Waiting Line - Hit & Run : Reason Magazine: "From our October issue, Mike Flynn, Shikha Dalmia, and Terry Colon show what it takes to legally immigrate to America. Click on the image below to see a larger version. Click again to expand it.

Help Reason celebrate its next 40 years. Donate Now!"

Help Reason celebrate its next 40 years. Donate Now!"

Wednesday, November 24, 2010

Bernanke's Solutions Are the Problem - Mark Thornton - Mises Daily

Bernanke's Solutions Are the Problem - Mark Thornton - Mises Daily: "Historically, deflation was a common feature of the American economy, particularly before the establishment of the Federal Reserve. The one time that there was significant deflation and economic decline was the Great Depression.

Two economists published a study in the American Economic Review in 2004 that examined the association of deflation with depression. They looked at 17 countries and over 100 years of data and concluded that 'beyond the Great Depression, the notion that deflation and depression are linked virtually disappears."

"Possibly the worst of Bernanke's statements occurred in 2006, near the zenith of the housing bubble and at a time when all the exotic mortgage manipulations were in their 'prime.' This was the era of the subprime mortgage, the interest-only mortgage, the no-documentation loan, and the heyday of mortgage-backed securities. At the time, the new Fed chairman admitted the possibility of 'slower growth in house prices,' but confidently declared that if this did happen he would just lower interest rates.

Bernanke stated in 2006 that he believed that the mortgage market was more stable than in the past. He noted in particular that 'our examiners tell us that lending standards are generally sound and are not comparable to the standards that contributed to broad problems in the banking industry two decades ago. In particular, real-estate appraisal practices have improved.'[4] This is the equivalent of the Federal Reserve seal of approval being applied to mortgage lending at the pinnacle of the housing bubble."

"He denied there was a housing bubble in 2005, he denied that housing prices could decrease substantively in 2005 and that it would affect the real economy and employment in 2006, and he tried to calm fears about the subprime-mortgage market. He stated that he expected reasonable growth and strength in the economy in 2007, and that the problem in the subprime market (which had then become apparent) would not impact the overall mortgage market or the market in general.

In mid-2007 he declared the global economy strong and predicted a quick return to normal growth in the United States."

"Austrians were writing about the housing bubble, its cause, and the probable outcomes as early as 2003. Bernanke and others have denied that you can predict bubbles and crises"

Two economists published a study in the American Economic Review in 2004 that examined the association of deflation with depression. They looked at 17 countries and over 100 years of data and concluded that 'beyond the Great Depression, the notion that deflation and depression are linked virtually disappears."

"Possibly the worst of Bernanke's statements occurred in 2006, near the zenith of the housing bubble and at a time when all the exotic mortgage manipulations were in their 'prime.' This was the era of the subprime mortgage, the interest-only mortgage, the no-documentation loan, and the heyday of mortgage-backed securities. At the time, the new Fed chairman admitted the possibility of 'slower growth in house prices,' but confidently declared that if this did happen he would just lower interest rates.

Bernanke stated in 2006 that he believed that the mortgage market was more stable than in the past. He noted in particular that 'our examiners tell us that lending standards are generally sound and are not comparable to the standards that contributed to broad problems in the banking industry two decades ago. In particular, real-estate appraisal practices have improved.'[4] This is the equivalent of the Federal Reserve seal of approval being applied to mortgage lending at the pinnacle of the housing bubble."

"He denied there was a housing bubble in 2005, he denied that housing prices could decrease substantively in 2005 and that it would affect the real economy and employment in 2006, and he tried to calm fears about the subprime-mortgage market. He stated that he expected reasonable growth and strength in the economy in 2007, and that the problem in the subprime market (which had then become apparent) would not impact the overall mortgage market or the market in general.

In mid-2007 he declared the global economy strong and predicted a quick return to normal growth in the United States."

"Austrians were writing about the housing bubble, its cause, and the probable outcomes as early as 2003. Bernanke and others have denied that you can predict bubbles and crises"

Tuesday, November 23, 2010

Soak-the-Rich Taxes: Fail! - Robert P. Murphy - Mises Daily

Soak-the-Rich Taxes: Fail! - Robert P. Murphy - Mises Daily: "But with a progressive (or graduated) tax code, the revenues flowing into state coffers increase more than proportionally. This is because the average taxpayer is earning a higher income and is paying a higher proportion of it in taxes.

On the other hand, revenues tend to crash much harder during recessions in those states that rely on steeply graduated income taxes. Not only are taxpayers in the state earning a lower income, but many of them slip into lower brackets and hence pay a lower percentage as well.

Democratic governments are notoriously short-term in their planning. During the boom times, when state coffers are overflowing with revenues, the state legislatures ramp up spending programs. When the bottom falls out during the next slump, the legislatures are caught in a difficult position. It is no coincidence that California and New York — states with very progressive income-tax codes — also have recurring difficulties in balancing their budgets."

"Back when the federal income tax was instituted in 1913, Americans were also promised that it would forevermore remain a slight irritant to the super wealthy. Initially it imposed a mere 1 percent tax on those making under $20,000, and a top rate of 7 percent on those making more than $500,000 — a fantastic sum in those days.

Yet in 1917, a mere four years later, the bottom rate had doubled from 1 percent to 2 percent. Someone in the $500,000 bracket now faced a tax rate of 54 percent. And the highest bracket, applicable to incomes exceeding $2 million, faced a tax rate of 67 percent. (The history of federal income-tax rates is available here.) Needless to say, Americans would not have agreed to a federal income tax in 1913 had they realized what the politicians would do with it."

On the other hand, revenues tend to crash much harder during recessions in those states that rely on steeply graduated income taxes. Not only are taxpayers in the state earning a lower income, but many of them slip into lower brackets and hence pay a lower percentage as well.

Democratic governments are notoriously short-term in their planning. During the boom times, when state coffers are overflowing with revenues, the state legislatures ramp up spending programs. When the bottom falls out during the next slump, the legislatures are caught in a difficult position. It is no coincidence that California and New York — states with very progressive income-tax codes — also have recurring difficulties in balancing their budgets."

"Back when the federal income tax was instituted in 1913, Americans were also promised that it would forevermore remain a slight irritant to the super wealthy. Initially it imposed a mere 1 percent tax on those making under $20,000, and a top rate of 7 percent on those making more than $500,000 — a fantastic sum in those days.

Yet in 1917, a mere four years later, the bottom rate had doubled from 1 percent to 2 percent. Someone in the $500,000 bracket now faced a tax rate of 54 percent. And the highest bracket, applicable to incomes exceeding $2 million, faced a tax rate of 67 percent. (The history of federal income-tax rates is available here.) Needless to say, Americans would not have agreed to a federal income tax in 1913 had they realized what the politicians would do with it."

Put Department of Education in Timeout | Richard W. Rahn | Cato Institute: Commentary

Put Department of Education in Timeout | Richard W. Rahn | Cato Institute: Commentary: "Suppose Congress said to the department, 'We are going to cut your budget and payroll by 20 percent per year until test scores start improving, and if they have not substantially improved within five years, the department will be dust.' What do you think would happen to test scores?"

"Most of the increase in spending has gone to education bureaucrats — including more and more layers of 'administrators' (assistant principals, deputy assistant principals, and on and on) — and much of it is needless overhead. So, as those in Congress cut back the department's funding, they must be smart about it — both for the sake of the students and for their own political protection. They need to insist that the funds be reduced for the middlemen and not the classroom teachers."

"Most of the increase in spending has gone to education bureaucrats — including more and more layers of 'administrators' (assistant principals, deputy assistant principals, and on and on) — and much of it is needless overhead. So, as those in Congress cut back the department's funding, they must be smart about it — both for the sake of the students and for their own political protection. They need to insist that the funds be reduced for the middlemen and not the classroom teachers."

Some gov't officials to skip airport security - FoxNews.com

Some gov't officials to skip airport security - FoxNews.com: "'Government officials traveling with approved federal law enforcement security details are not required to undergo security screening,' TSA spokesman Nicholas Kimball said, speaking about checkpoint security at airports. 'TSA follows a specialized screening protocol for federal law enforcement officers and those under their control, which includes identity verification.'

The TSA would not explain why it makes these exceptions. But many of the exempted government officials have gone through several levels of security clearances, including FBI background checks, and travel with armed law enforcement, eliminating the need for an additional layer of security at airports."

"Gainer added that members 'with sworn protection' are able to avoid security because 'their secure posture is affirmed by the law enforcement process established by TSA.'"

The TSA would not explain why it makes these exceptions. But many of the exempted government officials have gone through several levels of security clearances, including FBI background checks, and travel with armed law enforcement, eliminating the need for an additional layer of security at airports."

"Gainer added that members 'with sworn protection' are able to avoid security because 'their secure posture is affirmed by the law enforcement process established by TSA.'"

Gore: U.S. corn ethanol 'was not a good policy' | Green Tech - CNET News

Gore: U.S. corn ethanol 'was not a good policy' | Green Tech - CNET News: "'First-generation ethanol, I think, was a mistake. The energy conversion ratios are at best very small,' he said 'It's hard once such a program is put in place to deal with the lobbies that keep it going.'

He explained his own support for the original program on his presidential ambitions.

'One of the reasons I made that mistake is that I paid particular attention to the farmers in my home state of Tennessee, and I had a certain fondness for the farmers in the state of Iowa because I was about to run for president.'"

He explained his own support for the original program on his presidential ambitions.

'One of the reasons I made that mistake is that I paid particular attention to the farmers in my home state of Tennessee, and I had a certain fondness for the farmers in the state of Iowa because I was about to run for president.'"

Gore: U.S. corn ethanol 'was not a good policy' | Green Tech - CNET News

Gore: U.S. corn ethanol 'was not a good policy' | Green Tech - CNET News: "'First-generation ethanol, I think, was a mistake. The energy conversion ratios are at best very small,' he said 'It's hard once such a program is put in place to deal with the lobbies that keep it going.'

He explained his own support for the original program on his presidential ambitions.

'One of the reasons I made that mistake is that I paid particular attention to the farmers in my home state of Tennessee, and I had a certain fondness for the farmers in the state of Iowa because I was about to run for president.'"

He explained his own support for the original program on his presidential ambitions.

'One of the reasons I made that mistake is that I paid particular attention to the farmers in my home state of Tennessee, and I had a certain fondness for the farmers in the state of Iowa because I was about to run for president.'"

Monday, November 22, 2010

How an Economy Grows - George F. Smith - Mises Daily

How an Economy Grows - George F. Smith - Mises Daily: "the economy didn't grow because they consumed more. They consumed more because the economy grew"

"As productivity increased, prices fell, benefiting the producer as well as his customers. Falling prices induce people to save, which swells the amount of capital available for loans. The Keynesian fear of falling prices was yet unknown."

"As productivity increased, prices fell, benefiting the producer as well as his customers. Falling prices induce people to save, which swells the amount of capital available for loans. The Keynesian fear of falling prices was yet unknown."

Economists want to stop teachers' degree bonuses - FoxNews.com

Economists want to stop teachers' degree bonuses - FoxNews.com: "Every year, American schools pay more than $8.6 billion in bonuses to teachers with master's degrees, even though the idea that a higher degree makes a teacher more effective has been mostly debunked.

Despite more than a decade of research showing the money has little impact on student achievement, state lawmakers and other officials have been reluctant to tackle this popular way for teachers to earn more money."

Despite more than a decade of research showing the money has little impact on student achievement, state lawmakers and other officials have been reluctant to tackle this popular way for teachers to earn more money."

Cybersecurity bill gives DHS power to punish tech firms | Politics and Law - CNET News

Cybersecurity bill gives DHS power to punish tech firms | Politics and Law - CNET News: "Section 224 of HSCPIPA hands DHS explicit legal 'authorities for securing private sector' computers. A cybersecurity chief to be appointed by Napolitano would be given the power to 'establish and enforce' cybersecurity requirements."

Will computers with anti-government info be considered "unsecure"?

"Those requirements include presenting 'cybersecurity plans' to the agency, which has the power to 'approve or disapprove' each of them."

Will those plans need to include sensitive info that DHS might accidentally leak and increase security risks?

Will computers with anti-government info be considered "unsecure"?

"Those requirements include presenting 'cybersecurity plans' to the agency, which has the power to 'approve or disapprove' each of them."

Will those plans need to include sensitive info that DHS might accidentally leak and increase security risks?

Friday, November 19, 2010

Bernanke hits back at critics of bond-buying plan - FoxNews.com

Bernanke hits back at critics of bond-buying plan - FoxNews.com: "Without more stimulus, high unemployment could persist for years, he said."

We've heard that before and the forecast wasn't accurate.

We've heard that before and the forecast wasn't accurate.

Mom Panicked After Social Worker Picked Up Wrong Kids From Alaska School - FoxNews.com

Mom Panicked After Social Worker Picked Up Wrong Kids From Alaska School - FoxNews.com: "Kimberly Booth told The Anchorage Daily News that when she went to pick up her daughters Wednesday at Muldoon Elementary the staff told her a children's service worker had taken them. But when she called the Office of Children's Services she was told it didn't have the kids and didn't know what the school was talking about.

It turns out a social worker did pick up the girls, ages 6 and 8, because of a name mix up. The children were away from school about 45 minutes before the worker realized the mistake, brought them back to school and apologized."

It turns out a social worker did pick up the girls, ages 6 and 8, because of a name mix up. The children were away from school about 45 minutes before the worker realized the mistake, brought them back to school and apologized."

Tuesday, November 16, 2010

Driver In Fatal Conn. Crash Sues Victim's Parents for Letting Son Bike Without Helmet - FoxNews.com

Driver In Fatal Conn. Crash Sues Victim's Parents for Letting Son Bike Without Helmet - FoxNews.com: "Matthew Kenney's parents, Stephen and Joanne, sued 48-year-old driver David Weaving shortly after he was sentenced last year to 10 years in prison, accusing him in Waterbury Superior Court of negligence and seeking more than $15,000 in damages.

Weaving, who has a history of drunken driving convictions, responded months later with a handwritten countersuit accusing the Kenneys of 'contributory negligence.' He's also seeking more than $15,000 in damages, saying he's endured 'great mental and emotional pain and suffering,' wrongful conviction and imprisonment, and the loss of his 'capacity to carry on in life's activities.'

'It drags the pain on,' said Joanne Kenney, a stay-at-home mom with two other children, ages 2 and 13. 'It's a constant reminder. Enough is enough. Can you just leave us alone and serve your time?'"

Weaving, who has a history of drunken driving convictions, responded months later with a handwritten countersuit accusing the Kenneys of 'contributory negligence.' He's also seeking more than $15,000 in damages, saying he's endured 'great mental and emotional pain and suffering,' wrongful conviction and imprisonment, and the loss of his 'capacity to carry on in life's activities.'

'It drags the pain on,' said Joanne Kenney, a stay-at-home mom with two other children, ages 2 and 13. 'It's a constant reminder. Enough is enough. Can you just leave us alone and serve your time?'"

Friday, November 12, 2010

Johnson adhering to watchdog pledge | thenorthwestern.com | Oshkosh Northwestern

Johnson adhering to watchdog pledge | thenorthwestern.com | Oshkosh Northwestern: "Johnson is co-sponsoring a proposal DeMint intends to put on the table next week that would bar Senate Republicans from seeking earmarks for two years. The proposal puts old-guard Republicans and McConnell on the spot.

House Republicans already have an earmark ban and are expected to extend it when they caucus next week."

House Republicans already have an earmark ban and are expected to extend it when they caucus next week."

Thursday, November 11, 2010

Banks Are Lending More (to the Government) | Alan Reynolds | Cato Institute: Commentary

Banks Are Lending More (to the Government) | Alan Reynolds | Cato Institute: Commentary: "Talk of 'quantitative' easing makes it sound as if there will be a larger quantity of credit available to somebody somewhere. But the Fed is offering more credit only to Fannie Mae, Freddie Mac, and the U.S. Treasury."

"The next time you hear politicians or government officials complaining that banks are not lending enough to consumers or small businesses, just remind them that banks are much too busy lending tens of billions — to the U.S. government."

"The next time you hear politicians or government officials complaining that banks are not lending enough to consumers or small businesses, just remind them that banks are much too busy lending tens of billions — to the U.S. government."

Private Social Security Accounts: Still a Good Idea | William Shipman and Peter Ferrara | Cato Institute: Commentary

Private Social Security Accounts: Still a Good Idea | William Shipman and Peter Ferrara | Cato Institute: Commentary: "They were unfortunate to retire just one year after the worst 10-year stock market performance since 1926. Yet their account, having earned a 6.75% return annually from 1965 to 2009, would still pay them about 75% more than Social Security would have."

"It is a mathematical fact that the least expensive way to provide for an almost certain future liability is to save and invest in capital markets prior to the onset of the liability. That's why state and local pension funds, corporate pension plans, federal employee retirement plans and Chile's successful Social Security personal accounts (since copied by other countries) do so. It is sound practice.

And it's why Mr. Obama is wrong to assert that personal Social Security accounts are 'ill-conceived,' and why each of us should have the liberty to opt into one."

"It is a mathematical fact that the least expensive way to provide for an almost certain future liability is to save and invest in capital markets prior to the onset of the liability. That's why state and local pension funds, corporate pension plans, federal employee retirement plans and Chile's successful Social Security personal accounts (since copied by other countries) do so. It is sound practice.

And it's why Mr. Obama is wrong to assert that personal Social Security accounts are 'ill-conceived,' and why each of us should have the liberty to opt into one."

Blockading with Trade Restrictions | Jim Powell | Cato Institute: Commentary

Blockading with Trade Restrictions | Jim Powell | Cato Institute: Commentary: "He realized that if tariffs were really good, then civilization would have begun where people were cut off from the outside world by mountains, oceans, deserts and other natural barriers. But, he explained, 'it is where trade could best be carried on that we find wealth first accumulating and civilization beginning. It is on accessible harbors, navigable rivers and highways that we find cities arising and the arts and sciences developing.'

George wrote Protection or Free Trade because he hated monopolies. They could be maintained only if there were government-enforced restrictions that prevented people from dealing with alternative suppliers. He concluded that the most effective antitrust policy was free trade — consumers and businesses able to shop the world for the best values.

He explained why trade restrictions mainly harm nations that impose them: 'Every tariff that raises prices for the encouragement of one industry must operate to discourage all other industries into which the products of that industry enter. A tariff that raises the price of lumber necessarily discourages the industries which make use of lumber, from those connected with the building of houses and ships to those engaged in the making of matches and wooden toothpicks; a tariff that raises the price of salt discourages the dairyman and the fisherman; a tariff that raises the price of sugar discourages the fruit-preserver, the maker of syrups, and so on.'

George observed that nations try to prevent adversaries from trading, and a blockade is considered an act of war."

"George's most famous lines: 'Protective tariffs are as much applications of force as are blockading squadrons, and their object is the same — to prevent trade. The difference between the two is that blockading squadrons are a means whereby nations attempt to prevent their enemies from trading. Protective tariffs are a means whereby nations attempt to prevent their own people from trading. What protection teaches us is to do to ourselves in time of peace what enemies seek to do to us in time of war.'"

George wrote Protection or Free Trade because he hated monopolies. They could be maintained only if there were government-enforced restrictions that prevented people from dealing with alternative suppliers. He concluded that the most effective antitrust policy was free trade — consumers and businesses able to shop the world for the best values.

He explained why trade restrictions mainly harm nations that impose them: 'Every tariff that raises prices for the encouragement of one industry must operate to discourage all other industries into which the products of that industry enter. A tariff that raises the price of lumber necessarily discourages the industries which make use of lumber, from those connected with the building of houses and ships to those engaged in the making of matches and wooden toothpicks; a tariff that raises the price of salt discourages the dairyman and the fisherman; a tariff that raises the price of sugar discourages the fruit-preserver, the maker of syrups, and so on.'

George observed that nations try to prevent adversaries from trading, and a blockade is considered an act of war."

"George's most famous lines: 'Protective tariffs are as much applications of force as are blockading squadrons, and their object is the same — to prevent trade. The difference between the two is that blockading squadrons are a means whereby nations attempt to prevent their enemies from trading. Protective tariffs are a means whereby nations attempt to prevent their own people from trading. What protection teaches us is to do to ourselves in time of peace what enemies seek to do to us in time of war.'"

Wednesday, November 10, 2010

After November 2 | Michael D. Tanner | Cato Institute: Commentary

After November 2 | Michael D. Tanner | Cato Institute: Commentary: "Therefore, if this election is going to be the start of a long-term trend and not a one-time blip, the new Republican-dominated Congress is going to have to deliver. In particular, Republicans are going to have to follow through on their promises to reduce government spending and the deficit."

Highlights of deficit reduction proposals - FoxNews.com

Highlights of deficit reduction proposals - FoxNews.com: "Highlights of proposals by leaders of President Barack Obama's bipartisan deficit commission:"

"— Increase the Social Security retirement age by one month every two years after it reaches 67 under current law. It would reach 68 around 2050 and 69 around 2075."

"— Overhaul individual income taxes and corporate taxes. For individuals and families, eliminate a host of popular tax credits and deductions, including the child tax credit and the mortgage interest deduction. Significantly reduce income tax rates, with the top rate dropping to 23 percent from 35 percent.

— Reduce the corporate income tax rate to 26 percent from 35 percent, and stop taxing the overseas profits of U.S.-based multinational corporations."

"— Reduce congressional and White House budgets by 15 percent, freeze federal compensation at non-defense agencies for three years, cut the federal work force by 10 percent, eliminate 250,000 non-defense contractors and end money for commercial space flight.

— Eliminate noncompetitive spending bills known as 'earmarks.'

— End grants to large and medium-sized hub airports; require airports to fund a larger portion of the cost of aviation security.

— Cut funding for the public broadcasting."

Those sounds like good ideas.

"— Increase the Social Security retirement age by one month every two years after it reaches 67 under current law. It would reach 68 around 2050 and 69 around 2075."

"— Overhaul individual income taxes and corporate taxes. For individuals and families, eliminate a host of popular tax credits and deductions, including the child tax credit and the mortgage interest deduction. Significantly reduce income tax rates, with the top rate dropping to 23 percent from 35 percent.

— Reduce the corporate income tax rate to 26 percent from 35 percent, and stop taxing the overseas profits of U.S.-based multinational corporations."

"— Reduce congressional and White House budgets by 15 percent, freeze federal compensation at non-defense agencies for three years, cut the federal work force by 10 percent, eliminate 250,000 non-defense contractors and end money for commercial space flight.

— Eliminate noncompetitive spending bills known as 'earmarks.'

— End grants to large and medium-sized hub airports; require airports to fund a larger portion of the cost of aviation security.

— Cut funding for the public broadcasting."

Those sounds like good ideas.

Shipping Out Jobs | Daniel Griswold | Cato Institute: Commentary

Shipping Out Jobs | Daniel Griswold | Cato Institute: Commentary: "In 2008, US companies sold more than $6 trillion worth of goods and services through overseas affiliates — three times what US companies exported from America. And, no, those affiliates aren't mainly 'export platforms,' set up to ship goods back to the United States: Almost 90 percent of what they produce abroad is sold abroad.

It's not about access to 'cheap labor,' either: More than three-quarters of outward US manufacturing investment goes to other rich, developed economies like Canada and the European Union. That's where they find the wealthy customers, skilled workers, open markets, efficient infrastructure and political stability to operate profitably.

Indeed, US manufacturing companies invest a modest $2 billion a year in China, compared to $30 billion a year in Europe.

Nor do jobs created by those investments come at the expense of American workers. In fact, the more workers US multinationals hire abroad, the more they tend to hire at their parent operations in America."

It's not about access to 'cheap labor,' either: More than three-quarters of outward US manufacturing investment goes to other rich, developed economies like Canada and the European Union. That's where they find the wealthy customers, skilled workers, open markets, efficient infrastructure and political stability to operate profitably.

Indeed, US manufacturing companies invest a modest $2 billion a year in China, compared to $30 billion a year in Europe.

Nor do jobs created by those investments come at the expense of American workers. In fact, the more workers US multinationals hire abroad, the more they tend to hire at their parent operations in America."

Obama's Imaginary Tax Cuts | Richard W. Rahn | Cato Institute: Commentary

Obama's Imaginary Tax Cuts | Richard W. Rahn | Cato Institute: Commentary: "The tax increase of $725.7 billion dwarfs the tax cuts of $373 billion, leaving a net tax increase of $352 billion. But it gets worse. Just $107.6 billion of the tax cuts are permanent — the rest are temporary — but all of the $725.7 billion increases are permanent."

"The vast majority of these tax increases fall on middle- and lower-income people."

"'If Democrats are being truthful, why did they not enact the tax cuts before adjourning to campaign for re-election, when such an act would have been to their political advantage?' The answer is that they did not have a majority of Democrats who could agree on any specific tax-cut measure.

Remember, the lame-duck Congress will contain the same members who have been serving, even though, perhaps, 50 or 60 of them will have lost the election. What incentive do they have at that point to agree suddenly to tax cuts they previously opposed? Yes, the people might have spoken in favor of the cuts through the electoral process, but many of these defeated members will be more interested in returning home well before Christmas rather than spending time in Washington, debating tax-cut legislation. They also would be beholden to the president for appointments to new jobs."

"The vast majority of these tax increases fall on middle- and lower-income people."

"'If Democrats are being truthful, why did they not enact the tax cuts before adjourning to campaign for re-election, when such an act would have been to their political advantage?' The answer is that they did not have a majority of Democrats who could agree on any specific tax-cut measure.

Remember, the lame-duck Congress will contain the same members who have been serving, even though, perhaps, 50 or 60 of them will have lost the election. What incentive do they have at that point to agree suddenly to tax cuts they previously opposed? Yes, the people might have spoken in favor of the cuts through the electoral process, but many of these defeated members will be more interested in returning home well before Christmas rather than spending time in Washington, debating tax-cut legislation. They also would be beholden to the president for appointments to new jobs."

Monday, November 08, 2010

Mindless Partisanship Gets in the Way of Fighting Big Government | Gene Healy | Cato Institute: Commentary

Mindless Partisanship Gets in the Way of Fighting Big Government | Gene Healy | Cato Institute: Commentary: "In a 1988 survey, over half of self-identified 'strong Democrats' believed inflation had increased under President Reagan, when it had actually come down nearly 10 points. Half of the Republicans in a 1996 poll believed Bill Clinton had increased the deficit, though it dropped steadily during his tenure. Political scientist Adam J. Berinsky puts it starkly: 'In the battle between facts and partisanship, partisanship always wins.'

In 2004, psychologist Drew Westen took a look at the partisan mind through an MRI scanner. He presented 15 'strong Democrats' and 15 'strong Republicans' with negative statements about their favored candidates and watched which parts of their brains lit up.

'None of the circuits involved in conscious reasoning were particularly engaged,' Dr. Westen reported — it appeared 'as if partisans twirl the cognitive kaleidoscope until they get the conclusions they want.'"

In 2004, psychologist Drew Westen took a look at the partisan mind through an MRI scanner. He presented 15 'strong Democrats' and 15 'strong Republicans' with negative statements about their favored candidates and watched which parts of their brains lit up.

'None of the circuits involved in conscious reasoning were particularly engaged,' Dr. Westen reported — it appeared 'as if partisans twirl the cognitive kaleidoscope until they get the conclusions they want.'"

The Tempting Path of Protectionism | Jim Powell | Cato Institute: Commentary

The Tempting Path of Protectionism | Jim Powell | Cato Institute: Commentary: "By inflaming nationalist sentiment against the United States, Smoot-Hawley encouraged many governments to retaliate by enacting exchange controls that further throttled trade. By 1935, there were exchange controls in Afghanistan, Argentina, Austria, Bolivia, Brazil, Chile, China, Colombia, Costa Rica, Cuba, Czechoslovakia, Danzig, Ecuador, El Salvador, Finland, Germany, Greece, Hong Kong, Hungary, Iceland, Japan, Latvia, Lithuania, Luxembourg, Mexico, Netherlands, New Zealand, Nicaragua, Paraguay, Poland, Romania, Uruguay, Venezuela and Yugoslavia.

American farmers, who had lobbied hard for Smoot-Hawley, were among the biggest losers from all this. They saw their exports plunge from $1.8 billion in 1929 before Smoot Hawley to $590 million just four years later."

American farmers, who had lobbied hard for Smoot-Hawley, were among the biggest losers from all this. They saw their exports plunge from $1.8 billion in 1929 before Smoot Hawley to $590 million just four years later."

Rethinking Intellectual Property: History, Theory, and Economics - Stephan Kinsella - Mises Daily

Rethinking Intellectual Property: History, Theory, and Economics - Stephan Kinsella - Mises Daily: "Patent law finds its origins in mercantilist monopoly grants, and even legalized plunder — letters patent were used to legalize piracy in the 16th century — making it ironic for IP to be used against modern-day 'pirates' who are not real pirates at all."

A Better Way Than the VA? | Michael D. Tanner | Cato Institute: Commentary

A Better Way Than the VA? | Michael D. Tanner | Cato Institute: Commentary: "Democrats seem more concerned about preserving 'the system' than about results. The idea of giving people a private choice rather than keeping them confined to a government system is regarded as 'radical' and 'extreme.' You see it on issues ranging from education to Social Security. Apparently, the VA system has now become another such sacred cow."

The Fallacy of "Child-Labor-Free" - Rod Rojas - Mises Daily

The Fallacy of "Child-Labor-Free" - Rod Rojas - Mises Daily: "economic development is the precursor of all things good and humane. This sometimes even includes tangible expressions of parental love — a parent who puts a child behind a loom for ten hours a day does so, not out of callous greed, but because this is what brings food to the table.

Any ban or boycott on oriental rugs, or any other product of child labor, is utterly counterproductive and potentially life-threatening to the very people we are trying to protect. Only economic development can improve the lives of these children, and nothing short of unrestricted free trade will do."

Any ban or boycott on oriental rugs, or any other product of child labor, is utterly counterproductive and potentially life-threatening to the very people we are trying to protect. Only economic development can improve the lives of these children, and nothing short of unrestricted free trade will do."

The Real Reason for FDR's Popularity - Mark Thornton - Mises Daily

The Real Reason for FDR's Popularity - Mark Thornton - Mises Daily: "December 5, 1933, was the day of final liberation [from Prohibition], following nine months of frenzy and excitement. FDR successfully claimed credit for this, achieving a reputation as a great liberator. His popularity reached astounding heights. The glow never left."

Things Are Better Than You Imagine | Jason Kuznicki | Cato Institute: Commentary

Things Are Better Than You Imagine | Jason Kuznicki | Cato Institute: Commentary: "When asked what how much an average U.S. corporation's profits were as a percentage of sales, the students gave wild overestimates — the median student guessed corporate profits were 30% of sales; the upper quartile said more than 60%. The reality? More like 4%.

Goffe's students also thought inflation for the previous year (2008) had been about 11%. The Consumer Price Index, our best measure of inflation, rose by a mere .09% during that time, a small enough change that we could plausibly dismiss it as a measuring error.

Ordinary Americans make more money, too – the median student said that 35% of all workers earned the minimum wage. The real number is more like 1.7%.

And things are improving more than they imagine. When asked how much inflation-adjusted income had risen since 1950, the median student said 25%. Really, it's more like 248%.

Finally, our economy is freer than most of them imagine – when asked, the median student believed that the government sets 40% of market prices. Numbers for this one are harder to come by, but I asked some economist friends of mine, and it's certainly nowhere near that high. Governments do set prices on state-school tuitions, on Medicaid and Medicare-financed health spending, on cigarettes, and on a few others — but in all, prices are pretty free nowadays. Formerly, the federal and local governments had regulated airfare, trucking prices, and the prices of major consumer products like gasoline and apartment rents (there are still a few rent-controlled apartments, but good luck finding them!)."

Goffe's students also thought inflation for the previous year (2008) had been about 11%. The Consumer Price Index, our best measure of inflation, rose by a mere .09% during that time, a small enough change that we could plausibly dismiss it as a measuring error.

Ordinary Americans make more money, too – the median student said that 35% of all workers earned the minimum wage. The real number is more like 1.7%.

And things are improving more than they imagine. When asked how much inflation-adjusted income had risen since 1950, the median student said 25%. Really, it's more like 248%.

Finally, our economy is freer than most of them imagine – when asked, the median student believed that the government sets 40% of market prices. Numbers for this one are harder to come by, but I asked some economist friends of mine, and it's certainly nowhere near that high. Governments do set prices on state-school tuitions, on Medicaid and Medicare-financed health spending, on cigarettes, and on a few others — but in all, prices are pretty free nowadays. Formerly, the federal and local governments had regulated airfare, trucking prices, and the prices of major consumer products like gasoline and apartment rents (there are still a few rent-controlled apartments, but good luck finding them!)."

Hiding the Cost of Government Leads to Bigger Government | Christopher J. Conover | Cato Institute: Commentary

Hiding the Cost of Government Leads to Bigger Government | Christopher J. Conover | Cato Institute: Commentary: "When the federal government takes an additional dollar from taxpayers, the actual cost to society is generally $1.44. That extra 44 cents represents the deadweight loss of taxation. Every time Congress shifts another dollar from Peter to Paul, it leaves society 44 cents poorer.

The deadweight loss of taxation can be much higher, though. For example, if Congress allows income-tax rates to rise in January, as current law provides, it will cost society $1.50 for every dollar of new tax revenue. Feldstein estimates that each dollar of new income-tax revenue could cost society $2.65!"

"University of Chicago economist Harald Uhlig estimates that federal borrowing carries a much higher deadweight loss, such that every $1 of deficit spending ultimately costs society $4.40."

"The Office of Management and Budget already directs federal agencies to include the deadweight costs of federal taxes when doing cost-benefit analyses of federal spending. Congress should do the same."

The deadweight loss of taxation can be much higher, though. For example, if Congress allows income-tax rates to rise in January, as current law provides, it will cost society $1.50 for every dollar of new tax revenue. Feldstein estimates that each dollar of new income-tax revenue could cost society $2.65!"

"University of Chicago economist Harald Uhlig estimates that federal borrowing carries a much higher deadweight loss, such that every $1 of deficit spending ultimately costs society $4.40."

"The Office of Management and Budget already directs federal agencies to include the deadweight costs of federal taxes when doing cost-benefit analyses of federal spending. Congress should do the same."

Keeping the Poor in Poverty | Michael D. Tanner | Cato Institute: Commentary

Keeping the Poor in Poverty | Michael D. Tanner | Cato Institute: Commentary: "For example, few things are as important in helping people escape poverty as education."

"Yet Obama and the Democrats, in thrall to the teachers' unions, steadfastly resist proposals to give parents more control over their children's education. Washington, D.C., has a public-school system that, despite spending more per child than almost any other system in the nation, still has a dropout rate of more than 50 percent. Yet one of the first actions of the president and congressional Democrats was to kill the Opportunity Scholarship Program, which offered vouchers to permit poor children to opt out of the city's rotten public schools.

Across the country, efforts to increase parental choice are met with a wall of Democratic obstructionism. Choice, we are told, is a threat to the 'education system.' But which is really more important, the 'education system' or poor children?

And, of course, nothing is more important in fighting poverty than jobs. Yet the Obama administration is overtly hostile to the entrepreneurs and job creators in our economy. The wealthy are demonized rhetorically."

"We can't expect to create more jobs if we punish the type of activity that creates jobs. That means that if we wish to fight poverty, we must end those government policies — high taxes and regulatory excess — that inhibit growth and job creation. We must protect capital investment and give people the opportunity to start new businesses.

Along similar lines, one of the great advantages to reforming Social Security with personal accounts is that it would enable low-income Americans to save and accumulate wealth. But don't count on Democrats to lessen their opposition to the idea."

"Compassion is more than talking about the plight of the poor or giving them just enough money to make poverty a bit more comfortable. Real compassion is about creating the conditions that will enable the poor to get out of poverty."

"Yet Obama and the Democrats, in thrall to the teachers' unions, steadfastly resist proposals to give parents more control over their children's education. Washington, D.C., has a public-school system that, despite spending more per child than almost any other system in the nation, still has a dropout rate of more than 50 percent. Yet one of the first actions of the president and congressional Democrats was to kill the Opportunity Scholarship Program, which offered vouchers to permit poor children to opt out of the city's rotten public schools.

Across the country, efforts to increase parental choice are met with a wall of Democratic obstructionism. Choice, we are told, is a threat to the 'education system.' But which is really more important, the 'education system' or poor children?

And, of course, nothing is more important in fighting poverty than jobs. Yet the Obama administration is overtly hostile to the entrepreneurs and job creators in our economy. The wealthy are demonized rhetorically."

"We can't expect to create more jobs if we punish the type of activity that creates jobs. That means that if we wish to fight poverty, we must end those government policies — high taxes and regulatory excess — that inhibit growth and job creation. We must protect capital investment and give people the opportunity to start new businesses.

Along similar lines, one of the great advantages to reforming Social Security with personal accounts is that it would enable low-income Americans to save and accumulate wealth. But don't count on Democrats to lessen their opposition to the idea."

"Compassion is more than talking about the plight of the poor or giving them just enough money to make poverty a bit more comfortable. Real compassion is about creating the conditions that will enable the poor to get out of poverty."

For Orderly Dissolution of the Fed, before It Does Us Even More Harm | Jim Powell | Cato Institute: Commentary

For Orderly Dissolution of the Fed, before It Does Us Even More Harm | Jim Powell | Cato Institute: Commentary: "The Fed was established 97 years ago, and Fed officials were given considerable power over the economy as if they knew what they were doing, but they didn't. They're still winging it today.

The Fed failed its first big test in 1920 when the end of World War I was followed by the sharpest depression on record. Wholesale prices plunged more than 50%, the economy contracted by almost 24%, and unemployment doubled to 11%. This was the kind of crisis the Fed was supposed to prevent."

"in 2002, Ben Bernanke, then a Fed governor, acknowledged the Fed's role in these calamities: 'We did it. We're very sorry. We won't do it again.'"

"Intended to save our economy, the Fed has turned out to be perhaps the biggest single source of economic instability. It's the big pig at the trough, and it's unpredictable. It doesn't follow any rules consistently. When it moves, everyone else can be badly knocked around.

The very unpredictability of the Fed causes uncertainty that discourages investors and employers from making commitments for the future — an important reason why we're experiencing a sluggish, jobless recovery now.

Theoretically, the Fed might be able to work if there were perfect people, but there don't seem to be any of those around. After almost a century of the Fed's often violent roller-coaster rides, it's hard to see what might be accomplished with one more bit of tinkering such as with interest-rate targets.

It's time to begin planning for an orderly dissolution of the Fed before it does us any more harm."

The Fed failed its first big test in 1920 when the end of World War I was followed by the sharpest depression on record. Wholesale prices plunged more than 50%, the economy contracted by almost 24%, and unemployment doubled to 11%. This was the kind of crisis the Fed was supposed to prevent."

"in 2002, Ben Bernanke, then a Fed governor, acknowledged the Fed's role in these calamities: 'We did it. We're very sorry. We won't do it again.'"

"Intended to save our economy, the Fed has turned out to be perhaps the biggest single source of economic instability. It's the big pig at the trough, and it's unpredictable. It doesn't follow any rules consistently. When it moves, everyone else can be badly knocked around.

The very unpredictability of the Fed causes uncertainty that discourages investors and employers from making commitments for the future — an important reason why we're experiencing a sluggish, jobless recovery now.

Theoretically, the Fed might be able to work if there were perfect people, but there don't seem to be any of those around. After almost a century of the Fed's often violent roller-coaster rides, it's hard to see what might be accomplished with one more bit of tinkering such as with interest-rate targets.

It's time to begin planning for an orderly dissolution of the Fed before it does us any more harm."

No More Waiting for Superman | Neal McCluskey | Cato Institute: Commentary

No More Waiting for Superman | Neal McCluskey | Cato Institute: Commentary: "the ruin wreaked by socialized education is everywhere. Our best students do poorly compared to children in other developed nations — countries which, by the way, often embrace school choice. Worse, poor children are frequently locked into intellectual dungeons because their families are unable to afford a private school, or a house in a better district."

"Where we let freedom work, we have affordable abundance: from food, to iPods to automobiles. To get access to a decent school, in contrast, we force children to swarm around Bingo hoppers and pray that theirs will be among the few numbers called."

"Where we let freedom work, we have affordable abundance: from food, to iPods to automobiles. To get access to a decent school, in contrast, we force children to swarm around Bingo hoppers and pray that theirs will be among the few numbers called."

Tariffs Benefit Few, at Cost to All | Daniel J. Ikenson | Cato Institute: Commentary

Tariffs Benefit Few, at Cost to All | Daniel J. Ikenson | Cato Institute: Commentary: "A steel tariff of 20 per cent, for example, might enable domestic producers, through higher prices and greater market share, to increase profits by an aggregate $100 million a year. However, the typically larger costs associated with a steel tariff are borne by a mostly unwitting public, whose incentives to lobby against the tariffs are muted by the fact that those large costs are spread across millions of consumers. These costs include: higher prices for automobiles, appliances, housing, and transportation; lost export sales on account of foreigners having fewer exchange dollars or because of trade retaliation; and forgone opportunities to grow businesses that require affordable steel."

Homeowners say loan mods led them to foreclosure - FoxNews.com

Homeowners say loan mods led them to foreclosure - FoxNews.com: "the loan modification disputes are a legacy of the federal government's rush to stem the flow of foreclosures before it had adequate plans in place.

'These policymakers said, just go out and do this and don't let us worry about the details,' he said. 'These details are now what are coming to the fore in these modification cases.'

Laurie Maggiano, policy director at the Treasury Department's Homeownership Preservation Office, said banks were encouraged to offer trial modifications based on interviews with borrowers about their incomes and expenses while they sorted out the paperwork to qualify for permanently reduced payments."

"Casco said his monthly mortgage payments to Washington Mutual Inc. went up to $2,765 when he refinanced his home in 2006 to pay for a new a meat counter at his store in the industrial Los Angeles suburb of South Gate.

Chase was in the process of acquiring Washington Mutual in January 2009 when Casco said it sent a note telling him he qualified for a lower forbearance rate. The El Salvador native sent the tax returns and business documents the bank was requesting.

His payment was reduced to $1,250, where it remained for several months until Chase told him to apply for a trial loan modification.

Again, Casco said, he sent Chase the documentation they requested. His payment rose to $2,363 in June, then returned to the forbearance rate in October.

Casco said he continued paying what he was asked until August 2010, when Chase told his family that they were $50,000 behind on their payments and put them into foreclosure."

'These policymakers said, just go out and do this and don't let us worry about the details,' he said. 'These details are now what are coming to the fore in these modification cases.'

Laurie Maggiano, policy director at the Treasury Department's Homeownership Preservation Office, said banks were encouraged to offer trial modifications based on interviews with borrowers about their incomes and expenses while they sorted out the paperwork to qualify for permanently reduced payments."

"Casco said his monthly mortgage payments to Washington Mutual Inc. went up to $2,765 when he refinanced his home in 2006 to pay for a new a meat counter at his store in the industrial Los Angeles suburb of South Gate.

Chase was in the process of acquiring Washington Mutual in January 2009 when Casco said it sent a note telling him he qualified for a lower forbearance rate. The El Salvador native sent the tax returns and business documents the bank was requesting.

His payment was reduced to $1,250, where it remained for several months until Chase told him to apply for a trial loan modification.

Again, Casco said, he sent Chase the documentation they requested. His payment rose to $2,363 in June, then returned to the forbearance rate in October.

Casco said he continued paying what he was asked until August 2010, when Chase told his family that they were $50,000 behind on their payments and put them into foreclosure."

Saturday, November 06, 2010

The Impossibility of an Informed Electorate - D.W. MacKenzie - Mises Daily

The Impossibility of an Informed Electorate - D.W. MacKenzie - Mises Daily: "However, even those who follow politics very closely do not understand the implications of changes in public policy. The lesson here is that efforts to incrementally reform government policies and programs through the democratic process are futile. To the extent that we vote at all, rational people should vote to depoliticize the economy."

Kind slips past Kapanke to retain seat

Kind slips past Kapanke to retain seat: "Kapanke said it was easier to lose on a night when his party regained control of the U.S. House as well as both chambers of the state legislature.

“It was never about me,” he said. “The country’s in better hands. The state is in better hands.”"

"Outside interest groups targeted the largely agricultural district with an unprecedented level of spending — almost exclusively on the right — bankrolling attacks on Kind."

According to http://www.opensecrets.org/races/summary.php?cycle=2010&id=WI03 Kind received over $1,000,000 in PAC money (compared to $55,000 for Kapanke) -- that doesn't count "soft money" but it sounds like Kind got a lot of money from "Outside interest groups".

“It was never about me,” he said. “The country’s in better hands. The state is in better hands.”"

"Outside interest groups targeted the largely agricultural district with an unprecedented level of spending — almost exclusively on the right — bankrolling attacks on Kind."

According to http://www.opensecrets.org/races/summary.php?cycle=2010&id=WI03 Kind received over $1,000,000 in PAC money (compared to $55,000 for Kapanke) -- that doesn't count "soft money" but it sounds like Kind got a lot of money from "Outside interest groups".

Friday, November 05, 2010

The GOP Must Fight Earmarks | Michael D. Tanner | Cato Institute: Commentary

The GOP Must Fight Earmarks | Michael D. Tanner | Cato Institute: Commentary: "It is worth remembering that Ronald Reagan once vetoed a highway bill because it contained 152 earmarks, which he called 'a textbook example of special-interest politics at work.' Twenty years later, Republicans managed to put together a highway bill that contained 6,371."

"Many of the scandals that beset the last GOP Congress were the result of earmarks."

"earmarks are part and parcel of the deal-making and horse-trading that greases the skids for so much bad legislation in Washington. Vote against the leadership's pet legislation and your earmark gets cut off; vote for it and your district gets some delicious pork. And nothing helps an otherwise terrible bill gather votes better than stuffing it full of earmarked goodies for wavering lawmakers. Therefore, even a very small earmark can be used to leverage far more costly government spending."

"earmarks crowd out local private-capital investment and research-and-development spending, thereby slowing economic growth."

"If Republicans can't end earmarks, how can we expect them to make hard decisions when it comes to something like entitlements?"

"Many of the scandals that beset the last GOP Congress were the result of earmarks."

"earmarks are part and parcel of the deal-making and horse-trading that greases the skids for so much bad legislation in Washington. Vote against the leadership's pet legislation and your earmark gets cut off; vote for it and your district gets some delicious pork. And nothing helps an otherwise terrible bill gather votes better than stuffing it full of earmarked goodies for wavering lawmakers. Therefore, even a very small earmark can be used to leverage far more costly government spending."

"earmarks crowd out local private-capital investment and research-and-development spending, thereby slowing economic growth."

"If Republicans can't end earmarks, how can we expect them to make hard decisions when it comes to something like entitlements?"

Postal Bankruptcy | Doug Bandow | Cato Institute: Commentary

Postal Bankruptcy | Doug Bandow | Cato Institute: Commentary: "The USPS is in crisis. It is locked in a declining market. It can only survive with indirect taxpayer subsidies and a ban on private competition. Instead of forcing Americans to pay more for less service, Congress should open mail delivery to all comers.

The Constitution authorizes Congress "To establish Post Offices." But Congress is not required to institute government mail delivery, let alone a public mail monopoly. Today there is competition only in packages and urgent delivery. For regular mail, you must use the USPS, or else."

"the post office threatened to sue Boy Scouts who proposed delivering Christmas cards during the holidays. When the USPS learned of companies sending international mail abroad with traveling employees, it demanded payment for services not rendered."

"Years ago Australia, Germany, Finland, the Netherlands, New Zealand, and Sweden liberalized their postal regimes. The result, reported the OECD, was 'quality of service improvements, increases in profitability, increases in employment and real reductions in prices.' Since then the European Union has pushed continent-wide liberalization, especially by reducing the forms of mail "reserved" to government operations."

"the system remained bounded by regulations, cushioned by subsidies, and protected by its monopoly. In particular, USPS is exempt from taxes, regulations, and even parking tickets. Nevertheless, since 1971 the post office has lost money in 24 of 38 years."

"The average USPS salary is $83,500, which makes postal employees among the highest paid semi-skilled workers around."

The Constitution authorizes Congress "To establish Post Offices." But Congress is not required to institute government mail delivery, let alone a public mail monopoly. Today there is competition only in packages and urgent delivery. For regular mail, you must use the USPS, or else."

"the post office threatened to sue Boy Scouts who proposed delivering Christmas cards during the holidays. When the USPS learned of companies sending international mail abroad with traveling employees, it demanded payment for services not rendered."

"Years ago Australia, Germany, Finland, the Netherlands, New Zealand, and Sweden liberalized their postal regimes. The result, reported the OECD, was 'quality of service improvements, increases in profitability, increases in employment and real reductions in prices.' Since then the European Union has pushed continent-wide liberalization, especially by reducing the forms of mail "reserved" to government operations."

"the system remained bounded by regulations, cushioned by subsidies, and protected by its monopoly. In particular, USPS is exempt from taxes, regulations, and even parking tickets. Nevertheless, since 1971 the post office has lost money in 24 of 38 years."

"The average USPS salary is $83,500, which makes postal employees among the highest paid semi-skilled workers around."

Thursday, November 04, 2010

Biggest Election Night Losers: Self-funded Candidates - OpenSecrets Blog | OpenSecrets

Biggest Election Night Losers: Self-funded Candidates - OpenSecrets Blog | OpenSecrets: "Of the 58 federal-level candidates who contributed at least a half-million dollars to their own campaigns, fewer than one in five won the seat they had sought"

"Historically, self-financed candidates have had limited success at the federal level. Most of the candidates who've spent the most during the past two decades have lost"

"Historically, self-financed candidates have had limited success at the federal level. Most of the candidates who've spent the most during the past two decades have lost"

Wednesday, November 03, 2010

Scott Walker: Time for GOP to put up, or shut up - JSOnline

Scott Walker: Time for GOP to put up, or shut up - JSOnline: "Gov-elect Scott Walker told reporters in Milwaukee that after his election and a national Republican sweep that now 'it's put up or shut up time' for him and other newly elected leaders.

He said he and other new Republican office holders must do exactly as they promised voters in their campaigns."

He said he and other new Republican office holders must do exactly as they promised voters in their campaigns."

Who saved the day in Yemen bomb plot? Once again, a Muslim. - CSMonitor.com

Who saved the day in Yemen bomb plot? Once again, a Muslim. - CSMonitor.com: "But many of the key pieces of intelligence that set those networks into action came from Muslims – some former militants themselves – who have stepped forward to stop Islamist militants."

GOP Won on Economy, So Focus on It | David Boaz | Cato Institute: Commentary

GOP Won on Economy, So Focus on It | David Boaz | Cato Institute: Commentary: "It always feels great to win an election. But the real job for fiscal conservatives and smaller-government advocates starts now.

The usual pattern is that after the election, voters and the activists go back to their normal lives, but organized interests redouble their efforts to influence policymakers. The people who want something from government hire lobbyists, make political contributions and otherwise do all they can to get their hands on taxpayers' money."

"victorious Republicans must demonstrate to voters that they're serious — finally — about more freedom and less government."

"Republicans pledged to repeal it, and should keep their promise to voters. But, of course, the Senate and the president aren't likely to go along with a repeal bill. So the House should refuse to appropriate money to implement the bill's provisions, and prohibit the Department of Health and Human Services from spending any money to implement the bill's worst provisions — especially the individual mandate."

"As noted, the moment the polls close, the organized interest groups descend on the new members of Congress. From pharma to farmers, from oil companies to the Social Security/Medicare lobbyists, everybody wants to pay off a campaign debt and take a senator to a game at the Verizon Center. Republicans — and Democrats — need to show some virtue and resist these organized interest groups. The country's overriding interest is to reduce spending, the deficit and the national debt. That means keeping a comfortable distance between lobbyists and the public trough. One tactic might be for the House to pass a continuing resolution to fund agencies at 90 percent of current spending, bypassing the notoriously porcine appropriations subcommittees."

The usual pattern is that after the election, voters and the activists go back to their normal lives, but organized interests redouble their efforts to influence policymakers. The people who want something from government hire lobbyists, make political contributions and otherwise do all they can to get their hands on taxpayers' money."

"victorious Republicans must demonstrate to voters that they're serious — finally — about more freedom and less government."

"Republicans pledged to repeal it, and should keep their promise to voters. But, of course, the Senate and the president aren't likely to go along with a repeal bill. So the House should refuse to appropriate money to implement the bill's provisions, and prohibit the Department of Health and Human Services from spending any money to implement the bill's worst provisions — especially the individual mandate."

"As noted, the moment the polls close, the organized interest groups descend on the new members of Congress. From pharma to farmers, from oil companies to the Social Security/Medicare lobbyists, everybody wants to pay off a campaign debt and take a senator to a game at the Verizon Center. Republicans — and Democrats — need to show some virtue and resist these organized interest groups. The country's overriding interest is to reduce spending, the deficit and the national debt. That means keeping a comfortable distance between lobbyists and the public trough. One tactic might be for the House to pass a continuing resolution to fund agencies at 90 percent of current spending, bypassing the notoriously porcine appropriations subcommittees."

Will the Republican win turn into a conservative win?

The Republican party won big last night -- especially in Wisconsin where they took the Governor, Senate, and Assembly. Now we will have to see if they stick to the conservative ideals that I think most people expect of them.

Monday, November 01, 2010

Man bites dog? Google sues the government | Relevant Results - CNET News

Man bites dog? Google sues the government | Relevant Results - CNET News: "the Interior Department specified that the system needed to be part of Microsoft's Business Productivity Online Suite"

So what choices were there besides that?

So what choices were there besides that?

Subscribe to:

Comments (Atom)